Pravasi Bharatiya Bima Yojana (PBBY) Scheme Explained

- by kapil

- Updated Feb 19, 2026

- 6 mins read

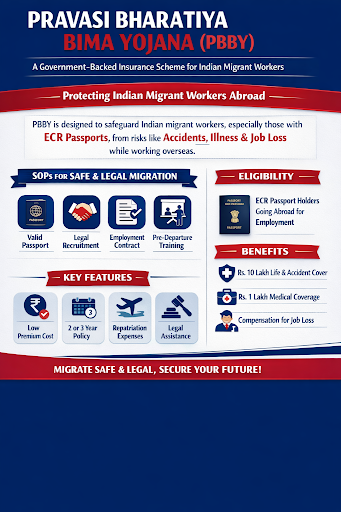

Pravasi Bharatiya Bima Yojana (PBBY) is a government-backed compulsory insurance scheme designed to safeguard Indian migrant workers, especially those with Emigration Check Required (ECR) passports, against risks like accidents, illness, and job loss while working abroad. Let’s understand its importance along with SOPs for Safe & Legal Migration, eligibility, benefits and other essentials.

What is PBBY?

Launched in 2003 by India’s Ministry of External Affairs and revised in 2017, PBBY protects low-skilled and semi-skilled emigrants heading to 18 ECR countries (e.g., UAE, Saudi Arabia, Qatar). It ensures financial security for workers and their families back home, covering everything from accidental death to medical emergencies. The scheme is mandatory for ECR passport holders getting emigration clearance, but now also open to ECNR holders. The PBBY is also an integral part of the Emigration process which is used by foreign employer licence holders to send workforce to ECR countries.

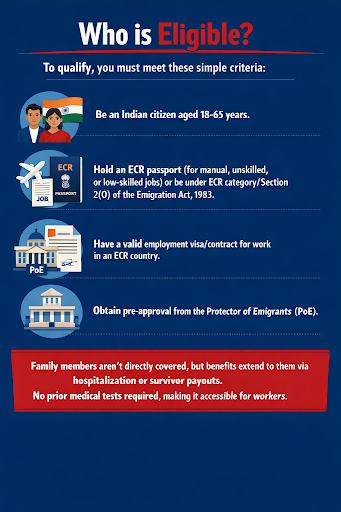

Who is Eligible?

To qualify, you must meet these simple criteria:

- Be an Indian citizen aged 18-65 years.

- Hold an ECR passport (for manual, unskilled, or low-skilled jobs) or be under ECR category/Section 2(O) of the Emigration Act, 1983.

- Have a valid employment visa/contract for work in an ECR country.

- Obtain pre-approval from the Protector of Emigrants (PoE).

Family members aren’t directly covered, but benefits extend to them via hospitalization or survivor payouts. No prior medical tests are needed, making it accessible for workers.

Also recruitment agents and foreign employers who are sending workers to ECR countries should make sure that workers enrol for PBBY insurance scheme as it is mandatory for the emigration clearance filing process. Additionally, recruiting agents should opt for credit insurance scheme for their own benefit.

Comprehensive Coverage Benefits

PBBY offers robust, all-inclusive protection worth up to INR 10 lakhs total. Here’s a clear breakdown:

| Benefit Type | Coverage Amount (INR) | Details |

| Accidental Death or Permanent Total Disability | Up to 10 lakhs | Lump-sum payout to nominee or worker; certified by Indian missions abroad. |

| Hospitalization (Abroad) | Up to 1 lakh (50,000 per incident) | Cashless or reimbursement for inpatient treatment; covers accidents/illnesses. |

| Family Hospitalization (India) | Up to 50,000 | For worker’s spouse/children/parents during hospitalization abroad. |

| Maternity Expenses | Up to 50,000 | Normal delivery or complications; after 9-month waiting period. |

| Legal Expenses | Up to 45,000 | For disputes like contract violations or detention. |

| Repatriation | Actual costs (up to limits) | Travel home if medically unfit, job loss, or death (body transport). |

Coverage is global and portable, you can change jobs, visit India, or switch countries without losing it.

Affordable Premiums and Duration

Keep costs low and simple:

- INR 275 for 2-year policy.

- INR 375 for 3-year policy.

Payable upfront via cash, online, or at PoE offices. No refunds, but multi-year options save money. Coverage starts after emigration clearance and lasts even if you return temporarily.

Step-by-Step Registration Process

Getting insured is straightforward, do it before leaving India:

- Visit a Protector of Emigrants (PoE) office or authorized agent.

- Submit passport, visa, employment contract, and photo.

- Buy from IRDAI-approved insurers like HDFC Ergo, Bajaj Allianz, Universal Sompo, or IFFCO Tokio.

- Use eMigrate portal for online self-registration and purchase.

- Get an instant policy document with a unique ID for claims.

Indian missions abroad can help with renewals or replacements. Always register via official channels to avoid fakes. Also, remember having proper insurance will help a foreign employer in a hasslefree employment process if you are planning to have a job in ECR countries.

Common Exclusions

PBBY doesn’t cover:

- Pre-existing diseases (4-year wait), specific illnesses (1-year wait), or OPD treatments.

- Self-harm, illegal acts, war, venereal diseases, or substance abuse.

- Accidents before policy activation.

Read the prospectus for full terms and conditions.

How to File a Claim

Claims are hassle-free with embassy support. Follow these steps to file a claim:

- Notify the insurer/Indian mission within 7 days of the incident.

- Submit docs: medical reports, death/disability certificate (from embassy), bills, passport copies.

- Get cashless treatment abroad or reimburse later (within 30 days).

Insurers settle quickly, often within weeks.

Helplines: Call MEA (1800-11-3090) or insurer toll-free.

Why PBBY Matters

This scheme brings peace of mind to millions of Indian workers employed by recruitment agents abroad like emigrate nurses, bridging gaps in foreign systems. Recent updates (as of 2025) emphasize digital access via eMigrate. For latest details, check mea.gov.in or your nearest PoE.

Frequently Asked Questions on PBBY

1. What is Pravasi Bharatiya Bima Yojana (PBBY)?

PBBY is a compulsory insurance scheme by India’s Ministry of External Affairs for emigrant workers, launched in 2003 and revised in 2017. It protects against accidents, hospitalization, and job-related issues abroad, offering up to INR 10 lakhs coverage.

2. Who is eligible for PBBY?

Indian citizens aged 18-60 (or up to 65 in some cases) with ECR passports or under ECR categories/Section 2(O) of the Emigration Act, holding valid employment visas for ECR countries. It now includes ECNR holders; no medical tests required.

3. What does PBBY cover?

Key benefits: INR 10 lakhs for accidental death/permanent disability; up to INR 1 lakh hospitalization abroad (INR 50,000 per incident); INR 50,000 for family hospitalization in India; INR 50,000 maternity; INR 45,000 legal expenses; repatriation costs. Coverage is global and portable.

4. How much is the premium and policy duration?

INR 275 for 2 years or INR 375 for 3 years, affordable and non-refundable. Buy from IRDAI-approved insurers; coverage starts post-emigration clearance and continues even if changing jobs or visiting India.

5. How do I register or buy a PBBY policy?

Visit Protector of Emigrants (PoE) offices, authorized agents, or use the eMigrate portal (services.india.gov.in) for online purchase. Submit passport, visa, contract; get instant policy from insurers like HDFC Ergo or Bajaj Allianz.

6. What are common exclusions under PBBY?

No coverage for pre-existing diseases (4-year wait), OPD, self-harm, illegal acts, war, venereal diseases, or pre-policy accidents. Maternity has a 9-month wait; specific illnesses wait 1 year.

7. How can I file a claim under PBBY?

Notify insurer/Indian mission within 7 days; submit death/disability certificates (embassy-issued), medical bills, passport copies. Cashless hospitalization abroad or reimbursement within 30 days; settlements are fast.

8. Can I renew PBBY online, and does it cover family directly?

Yes, renew easily online via eMigrate or insurer portals without hassle. Family gets indirect benefits like INR 50,000 hospitalization in India if you’re hospitalized/deceased abroad, but not direct coverage.