New Startup Recognition & Deep Tech Rules 2026: Key Reforms

- by kapil

- Updated Feb 19, 2026

- 8 mins read

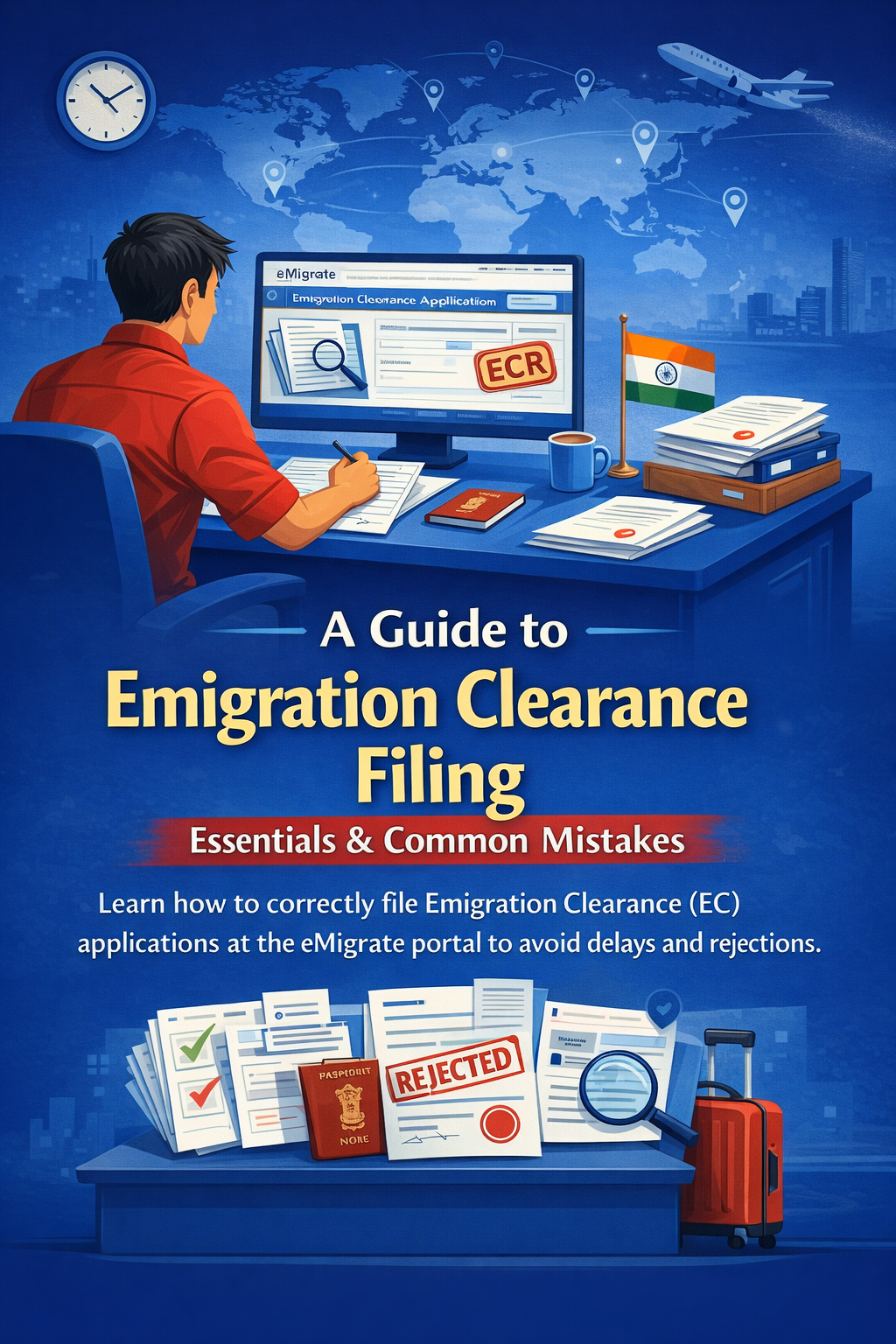

As of early 2025, India stands as the world’s third-largest startup ecosystem, with more than 1.59 lakh startups officially recognised by the Department for Promotion of Industry and Internal Trade (DPIIT) and recently it has released new startup recognition & deep tech rules which is going to redefine whole landscape. These DPIIT-recognised startups, spread across 669 districts, reflect the deep geographic penetration of entrepreneurship in the country, with over 51% emerging from Tier II and Tier III cities. The ecosystem is no longer concentrated in metros alone; innovation is increasingly being driven from smaller cities across India.

India’s startup landscape has also achieved significant global prominence, with over 100 unicorns, startups valued at USD 1 billion or more operating across diverse sectors such as IT services, healthcare, and agriculture. Women-led entrepreneurship has seen notable momentum, with more than 73,000 recognised startups having at least one woman director. The ecosystem continues to expand at a steady annual growth rate of 12–15%, underlining its resilience and long-term potential.

Beyond valuation and scale, startups have become a major engine of employment, collectively generating over 1.6 million jobs as of June 2022. Against this backdrop of rapid growth and increasing complexity, the Government of India has revised the regulatory framework governing startup recognition. In February 2026, DPIIT issued a revised notification redefining what qualifies as a Startup and formally introducing the category of Deep Tech Startup, with enhanced age and turnover thresholds to better support long-gestation, research-intensive ventures.

What Is the Revised DPIIT Startup Framework?

Under the new DPIIT notification, an entity will be recognised as a Startup if it satisfies specific conditions relating to its legal structure, age, turnover, and nature of business.

Eligible Entity Types

A Startup must be incorporated or registered in India as one of the following:

- Private Limited Company under the Companies Act, 2013

- Partnership Firm registered under the Partnership Act, 1932

- Limited Liability Partnership (LLP) under the LLP Act, 2008

- Multi-State Cooperative Society registered under the Multi-State Cooperative Societies Act, 2002

- State or Union Territory Cooperative Society registered under applicable state or UT laws

Age Limit for Startups

- The entity must be within 10 years from the date of incorporation or registration.

Turnover Limit

- The turnover of the entity must not exceed ₹200 crore in any financial year since incorporation.

Nature of Business Requirement

The entity must be working towards:

- Innovation, development, or improvement of products, processes, or services, or

- A scalable business model with high potential for employment generation or wealth creation.

Entities Not Considered as Startups

- Businesses formed by splitting up or reconstruction of an existing business are not eligible for startup recognition.

When Does Startup Status End?

An entity will cease to be a Startup if:

- It completes 10 years from incorporation or registration, or

- Its turnover exceeds ₹200 crore in any previous financial year.

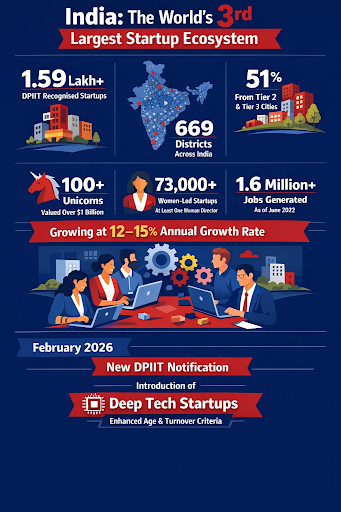

What Is a Deep Tech Startup?

One of the most important changes in the 2026 notification is the formal recognition of Deep Tech Startups.

A Deep Tech Startup is not just innovation-led, but science- and technology-intensive, requiring long-term research and significant investment.

Under new framework a Deep Tech Startup in addition to meeting standard startup criteria, should demonstrate the following characteristics:

- It works on solutions based on new scientific or engineering knowledge, either under development or yet to be developed.

- It has a high proportion of R&D expenditure compared to its revenue or funding.

- It owns or is creating significant novel intellectual property (IP) and is actively working towards commercialization.

- It faces long development timelines, extended gestation periods, high capital and infrastructure requirements, and substantial scientific or technical uncertainty.

Recognition as a Deep Tech Startup is determined by DPIIT based on frameworks, parameters, and documents submitted by the applicant.

Special Relaxations for Deep Tech Startups

To support long-gestation technology ventures, DPIIT has provided enhanced thresholds for Deep Tech Startups.

| Criteria | Startup | Deep Tech Startup |

| Maximum age | 10 years | 20 years |

| Maximum turnover | ₹200 crore | ₹300 crore |

A Deep Tech Startup will lose its status if:

- It completes 20 years from incorporation or registration, or

- Its turnover exceeds ₹300 crore in any previous financial year.

For legal and policy purposes, Deep Tech Startups are treated as Startups unless specifically stated otherwise.

DPIIT Startup Recognition Process

To obtain official recognition, an eligible entity must apply through the DPIIT Startup portal.

Documents Required

- Certificate of incorporation or registration

- A write-up explaining the nature of business and how it meets innovation or scalability criteria

- Additional documentation for Deep Tech Startups demonstrating compliance with deep tech attributes

DPIIT’s Role

After reviewing the application and documents, DPIIT may:

- Grant recognition as a Startup or Deep Tech Startup, or

- Reject the application with recorded reasons.

Tax Certification Under Section 80-IAC

Recognised Startups, including Deep Tech Startups, may apply for tax benefits under Section 80-IAC of the Income-tax Act.

Eligibility for 80-IAC Certification

- The entity must be a Private Limited Company or LLP

- It must meet conditions prescribed under Section 80-IAC

Application Procedure

- Application must be submitted in Form-1 to the Inter-Ministerial Board of Certification

- The Board may request additional documents or clarifications before deciding

The Board has the authority to grant or reject certification with reasons.

Conditions on Use of Funds

During the recognition period, startups must primarily deploy their funds towards:

- Core business operations

- Innovation and research

- Scaling and expansion

- Operational requirements

Startups are restricted from investing in assets such as real estate, luxury assets, speculative investments, loans, and capital contributions to other entities, unless such investments are integral to their core business operations.

Revocation of Recognition

If a Startup or Deep Tech Startup obtains recognition or tax certification based on false or misleading information, DPIIT or the Certification Board may revoke the approval. Once revoked, the recognition is treated as if it was never granted.

Government’s Power to Relax Conditions

The Central Government retains the authority to:

- Relax or modify conditions for specific classes of startups

- Grant exemptions in special or exceptional cases

Conclusion

The revised DPIIT notification marks a significant step in strengthening India’s startup ecosystem, particularly for Deep Tech ventures that require time, capital, and scientific rigor. By extending age and turnover limits and formalising deep tech recognition, the government has created a more realistic and supportive policy framework for innovation-driven businesses.

Startups working in advanced technology, R&D, and IP-led sectors should carefully evaluate these changes and consider applying for Deep Tech Startup recognition to access extended benefits and regulatory support.

FAQ’s on new DPIIT Rules on Startups

- What is the revised DPIIT definition of a startup in 2026?

Under the revised DPIIT notification issued in February 2026, a startup is an entity incorporated or registered in India as an eligible legal form, within 10 years of incorporation, with turnover not exceeding ₹200 crore in any financial year, and working towards innovation, improvement of products or services, or a scalable business model with employment or wealth creation potential. - What new changes has DPIIT introduced for startups in 2026?

The 2026 revision updates the startup definition, formally introduces the Deep Tech Startup category, increases age and turnover limits for deep tech entities, and clarifies eligibility, recognition, fund-usage conditions, and revocation provisions. - What is a Deep Tech Startup under the DPIIT notification?

A Deep Tech Startup is a DPIIT-recognised startup that is built on advanced scientific or engineering innovation, involves high R&D intensity, creates or commercialises novel intellectual property, and faces long development cycles, capital-intensive requirements, and technical uncertainty. - What are the age and turnover limits for Deep Tech Startups?

Deep Tech Startups can be recognised for up to 20 years from incorporation and can have turnover of up to ₹300 crore in any financial year, which is higher than the limits applicable to regular startups. - How can a startup apply for DPIIT recognition?

A startup must apply through the official DPIIT Startup India portal by submitting its incorporation documents and a write-up explaining its innovation, scalability, or business model. Deep Tech Startups must also submit additional technical and R&D-related documentation. - Can an existing business restructuring qualify as a startup?

No, entities formed by splitting up or reconstructing an existing business are explicitly excluded from being recognised as startups under the DPIIT framework. - What benefits does DPIIT recognition provide to startups?

DPIIT recognition enables startups to access government schemes, easier compliance norms, funding opportunities, and eligibility to apply for tax benefits under Section 80-IAC of the Income-tax Act, subject to certification. - What is Section 80-IAC certification and who can apply?

Section 80-IAC provides tax exemptions to eligible startups that are private limited companies or LLPs. Recognised startups can apply for certification through the Inter-Ministerial Board by submitting Form-1 along with supporting documents. - Are there restrictions on how recognised startups can use their funds?

Yes, recognised startups must primarily use funds for core business activities, innovation, R&D, scaling, and operations. Investments in real estate, luxury assets, speculative instruments, or unrelated entities are restricted unless integral to the core business. - Can DPIIT revoke startup or Deep Tech Startup recognition?

Yes, if recognition or certification is obtained using false or misleading information, DPIIT or the Certification Board has the authority to revoke it, and such approval will be treated as if it was never granted.