AEO Registration in India

- by gautam

- Updated Jun 28, 2025

- 8 mins read

The Authorised Economic Operator (AEO) registration is a flagship programme by the Central Board of Indirect Taxes and Customs (CBIC) under the World Customs Organization’s SAFE Framework.

It is designed to recognize and certify businesses involved in international trade that demonstrate high standards of compliance, security, and reliability in the global supply chain.

The AEO status offers a range of benefits such as expedited customs clearance, reduced inspections, and deferred duty payments.

It promotes seamless cross-border trade by fostering trusted partnerships between businesses and customs authorities, thereby improving efficiency and security throughout the import-export ecosystem.

There are four categories of AEO status:

| AEO Category | Validity | Eligible Entities | Key Requirement |

|---|---|---|---|

| AEO-T1 | 3 years | Importers/Exporters | Basic documentation and process compliance |

| AEO-T2 | 5 years | Importers/Exporters | Includes physical verification |

| AEO-T3 | 5 years | Continuously AEO-T2 certified for 2+ years | Strong track record and AEO partners |

| AEO-LO | 5 years | Logistics Operators, Brokers, Warehouses | Security protocols and site plans |

Requirements / Eligibility Criteria for AEO Registration

To apply for AEO (Authorised Economic Operator) registration in India, the applicant must fulfill the following eligibility criteria and requirements, as per the CBIC guidelines:

- Business Experience: Must have been involved in customs-related international trade activities in India for at least 3 financial years.

- Legal Establishment: Must be legally established in India with valid documentation such as:

- Certificate of Incorporation or Business Registration

- Proof of registered office and operational premises

- Customs Activity Threshold: Minimum 25 import/export documents (Bills of Entry or Shipping Bills) in the last financial year.

- Financial Solvency:

- Should be financially solvent over the past 3 years.

- No bankruptcy, liquidation, or significant financial default.

- Legal Compliance:

- No Show Cause Notices (SCNs) involving fraud, forgery, or smuggling in the last 3 years.

- No ongoing prosecution or legal proceedings against the applicant or key personnel.

- Security Standards (Applicable for AEO-T2, T3, LO): Must have a documented Security Plan, covering:

- Premises security

- Personnel and cargo security

- Security training & threat awareness

- Business partner due diligence

- Process & Site Maps: Should provide:

- A process map showing the flow of goods

- A site plan indicating access control, CCTV, and physical security arrangements

- Accounting & Record Management:

- Must follow GAAP or IFRS-compliant accounting practices

- Maintain proper documentation and internal controls to detect irregularities

- Effective systems for managing licenses and authorizations

- Business Partner Disclosure (For AEO-T3): Must disclose information about associated custom brokers, logistics service providers, warehouse operators, etc.

- Physical Verification: Required for AEO-T2, T3, and LO applicants to validate the provided information and security compliance.

- Continuity for AEO-T3:

- Must have held AEO-T2 status continuously for at least 2 years before applying for AEO-T3.

- All key business partners must also be AEO-T2/LO certified or hold equivalent foreign certification.

Meeting these requirements is essential to initiate and complete the AEO registration procedure successfully.

Procedure for AEO Registration in India

The Authorised Economic Operator (AEO) registration process is structured, transparent, and largely digitized to promote ease of doing business. Below is a step-by-step procedure to apply for AEO certification in India:

- Step 1: Self-Assessment & Readiness Check

- Evaluate your company’s eligibility against the prescribed criteria.

- Identify the desired AEO Tier (T1, T2, T3, or LO).

- Conduct an internal gap analysis to address compliance, documentation, and security requirements.

- Step 2: Online Application Filing

- Visit the official AEO portal: www.aeoindia.gov.in

- Register your organization and create login credentials.

- Fill out the online AEO application form with accurate business, legal, financial, and customs-related information.

- Use our application filling guide to avoid delays due to errors or omissions.

- Step 3: Document Upload

- Upload all required documents including:

- Business registration certificates

- IEC code, GST certificate

- Financial statements

- Site and process maps

- Security plans (for T2, T3, LO)

- Internal SOPs, audit procedures, and legal declarations

- Upload all required documents including:

- Step 4: Preliminary Review by Zonal AEO Cell

- Your application will be acknowledged and assigned to the respective Zonal AEO Cell.

- If any deficiency is found, it will be communicated within 30 days and must be rectified for further processing.

- Step 5: Assessment & Verification

| Tier | Verification Requirement | Timeframe (Approx.) |

| AEO-T1 | Desk-based review only | Certificate issued within 30 days |

| AEO-T2/LO | Includes physical verification by AEO team | Up to 90 days for site visit |

| AEO-T3 | Extensive verification + partner evaluation | After 2 years of T2 certification |

Physical verification (if required) is done within 90 days, followed by a compliance report within 60 days.

- Step 6: Final Approval & Certification

- If compliant, the AEO certificate is granted within 30 days after the verification process.

- The certificate is sent in physical and digital format by the AEO Programme Manager.

- Step 7: Post-Certification Support

- Maintain compliance throughout the certificate validity period (3–5 years depending on the tier).

- Prepare for periodic reviews or reassessments if initiated by Customs.

Advantages of AEO Registration

Becoming an Authorised Economic Operator (AEO) offers a wide range of strategic, operational, and financial benefits for businesses engaged in international trade. These advantages vary depending on the AEO tier (T1, T2, T3, or LO), but all contribute to enhanced trade facilitation, reduced costs, and improved compliance standing.

Key Benefits of AEO Certification:

| Benefit Category | AEO-T1 | AEO-T2 | AEO-T3 |

|---|---|---|---|

| Brand Recognition | ✔ Recognized as Trusted Partner | ✔ Enhanced reputation | ✔ Premium global standing |

| Customs Clearance Speed | ✔ Faster processing | ✔ Priority processing | ✔ Highest priority |

| Examination & Scanning | ✔ Reduced interventions | ✔ Priority scanning | ✔ Scanning waived |

| Seal Verification by Customs | Required | Waived | Waived |

| Bank Guarantee Waiver | 50% | 75% | 100% |

| Deferred Duty Payment Facility | ❌ Not Available | ✔ Available | ✔ Available |

| Dedicated Relationship Manager (RM) | ❌ | ❌ | ✔ Assigned by Customs |

| ICEGATE Data Access | ❌ | ✔ Available | ✔ Available |

| Facility for Direct Port Delivery (DPD) | ✔ Available | ✔ Available | ✔ Available |

| Facility for Direct Port Entry (DPE) | ✔ Available | ✔ Available | ✔ Available |

| Separate Custodian Space | ✔ | ✔ | ✔ |

| Faster Refunds & Drawbacks | ❌ | ✔ IGST & duty drawbacks | ✔ Fastest processing |

| Faster Resolution of Tax Disputes | ✔ | ✔ | ✔ |

| MRP Labelling at Premises | ❌ | ✔ Allowed | ✔ Allowed |

| SVB (Special Valuation Branch) Speed-up | ❌ | ❌ | ✔ Yes |

Documents Required for AEO Registration

The documentation required for Authorised Economic Operator (AEO) registration varies slightly depending on the tier (T1, T2, T3, or LO), but the core objective is to establish the applicant’s legal status, financial soundness, security practices, and customs compliance.

Common Documents for All Applicants (AEO-T1, T2, T3, LO):

- Self-Declaration Forms – For compliance, solvency, etc.

- Certificate of Incorporation / Business Registration

- Import Export Code (IEC)

- GST Registration Certificate

- List of Import/Export Documents

- Minimum 25 Bills of Entry or Shipping Bills (past FY)

- Financial Statements

- Audited Balance Sheets & Profit & Loss statements for the last 3 years

- PAN Card of the Entity

- Board Resolution / Authorization Letter

- Copy of Customs Registrations (if applicable)

- Process Map – Showing flow of goods in supply chain

- Site Plan – Illustrating office/premises layout with access points and security systems

Additional Documents for AEO-T2, T3, and LO:

| Document Type | T2 | T3 | LO |

|---|---|---|---|

| Detailed Security Plan | ✔ | ✔ | ✔ |

| Business Partner Details (custom brokers, LSPs, etc.) | ❌ | ✔ | ❌ |

| SOPs for Record Maintenance & Licenses | ✔ | ✔ | ✔ |

| Threat Awareness & Training Protocols | ✔ | ✔ | ✔ |

| Internal Audit Reports | ✔ | ✔ | ✔ |

| Customs Compliance History | ✔ | ✔ | ✔ |

| HR Policy & Role Assignment Records | ✔ | ✔ | ✔ |

Can a newly established company apply for AEO status?

No. A company must have a minimum of three financial years of customs-related business activity in India before applying.

What is the cost of applying for AEO certification?

There is no government fee for AEO registration. However, you may incur costs for consulting, documentation, and internal readiness activities.

Can AEO status be suspended or revoked?

Yes. Customs may suspend or revoke the AEO status if the entity fails to maintain compliance or is involved in fraudulent activities.

Is it necessary to renew AEO certification?

Yes. AEO certificates have a validity of 3 to 5 years, depending on the tier, and must be renewed before expiry through re-assessment.

Can AEO benefits be transferred to subsidiaries or group companies?

No. AEO benefits are entity-specific and cannot be transferred to subsidiaries or associated entities unless they are individually certified.

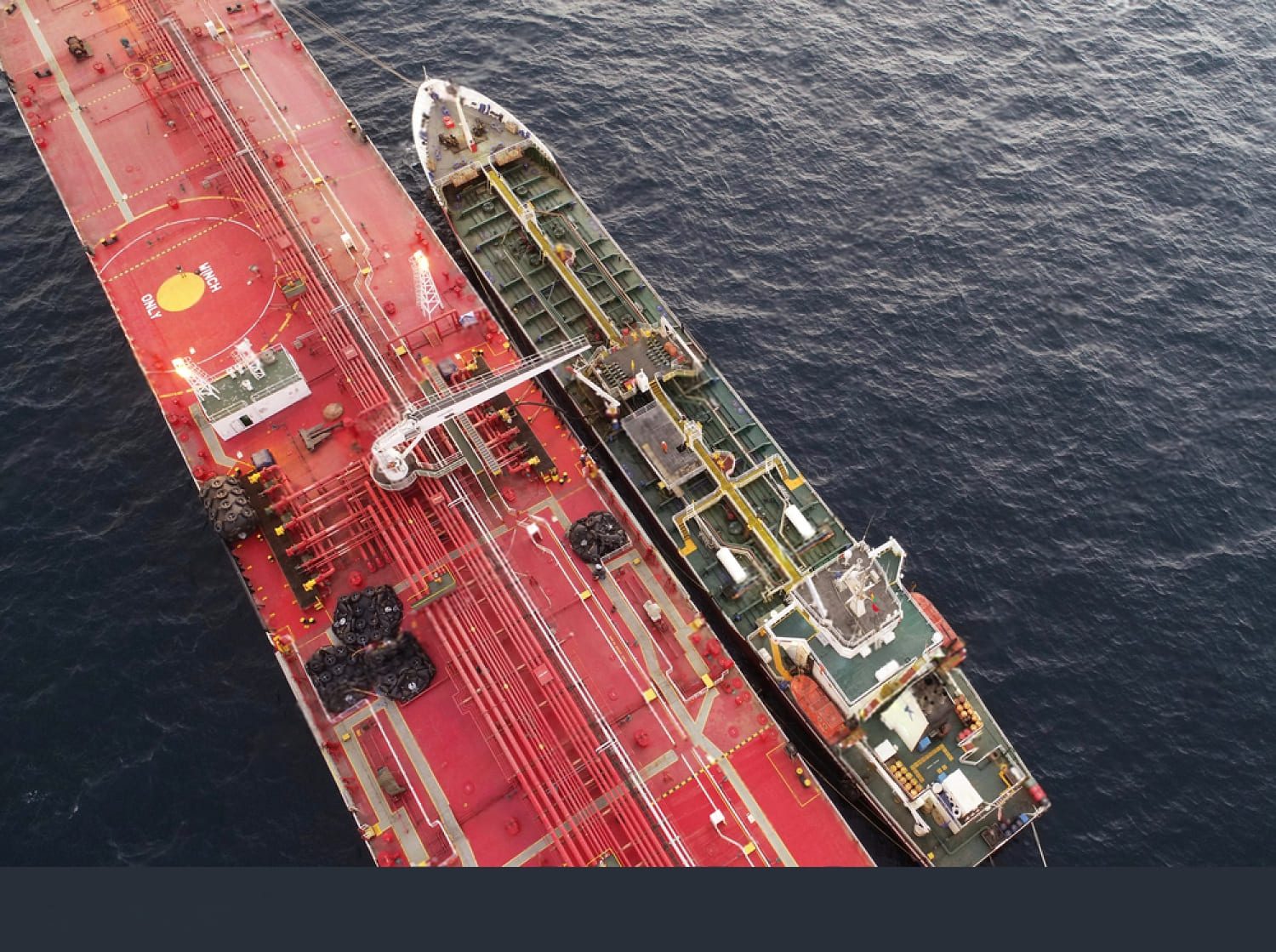

Is physical verification conducted at all locations?

For T2/T3/LO applicants, physical verification is conducted at key operational locations, especially where cargo is loaded/unloaded or stored.

Can foreign companies apply for AEO in India?

Only companies legally established in India with Indian IEC and GST registration can apply for AEO status under Indian Customs.

What if an entity has multiple IEC codes?

Each IEC must apply separately for AEO certification unless operations are legally consolidated under one IEC.

Does AEO certification cover both import and export activities?

Yes. AEO applies to both importers and exporters, and its benefits are available across both verticals.

Is online submission mandatory for AEO application?

Yes. The application must be filed and tracked online through the official AEO portal.

How can I check the status of my AEO application?

You can log in to the AEO portal to track application status or communicate with the assigned Zonal AEO Cell.

Can we apply for AEO directly without a consultant?

Yes, though hiring a consultant helps ensure accurate documentation, faster processing, and better compliance.

Do I need to re-submit documents during renewal?

Yes. During renewal, updated versions of all relevant documents and proof of continued compliance are required.

Are there any industry-specific restrictions for AEO?

No. Any business dealing in international trade and customs can apply, regardless of industry.

Does AEO certification affect DGFT or RBI compliance?

No directly, but holding AEO status demonstrates high compliance standards, which may indirectly support smoother interactions with other authorities.